TRX Price Prediction: Technical Breakout Likely Amid Strong Fundamentals

#TRX

- Technical indicators show bullish MACD momentum with price consolidation below the 20-day moving average

- Fundamental developments including Tether integration and US Department of Commerce partnership provide strong adoption catalysts

- Significant institutional investment with Tron Inc.'s $220 million treasury allocation demonstrates corporate confidence

TRX Price Prediction

Technical Analysis: TRX Shows Bullish Momentum Despite Minor Resistance

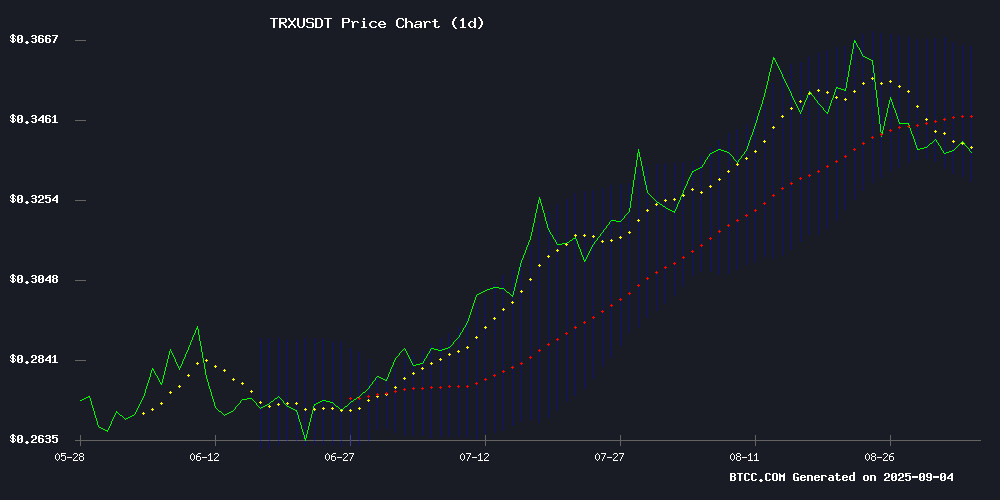

TRX is currently trading at $0.3389, slightly below its 20-day moving average of $0.3478, indicating potential consolidation. The MACD reading of 0.006579 above the signal line suggests building bullish momentum, while the Bollinger Bands position shows price action NEAR the middle band with room to test the upper resistance at $0.365. BTCC financial analyst William notes: 'The technical setup favors gradual upward movement, with key resistance at the upper Bollinger Band level.'

Fundamental Catalysts Drive TRX Optimism

Tether's integration with TRON via deBridge enhances utility, while the partnership with the US Department of Commerce for on-chain economic data represents significant institutional adoption. Tron Inc.'s $220 million treasury allocation underscores corporate confidence. William comments: 'These developments create strong fundamental tailwinds that could propel TRX beyond technical resistance levels in the medium term.'

Factors Influencing TRX's Price

Tether’s USDT Now Seamlessly Integrates with TRON via deBridge

Tether has announced the full integration of its USDT stablecoin with the TRON blockchain through deBridge's cross-chain technology. This development marks a significant advancement in stablecoin interoperability, enabling seamless transactions across diverse blockchain networks.

TRON's dominance in the stablecoin market makes it an ideal partner, with over $82 billion worth of USDT currently in circulation on its network. The blockchain's robust infrastructure, supporting 327 million accounts and processing more than 11 billion transactions, ensures secure and efficient transfers without the need for wrapped tokens.

The collaboration between Tether and deBridge addresses growing user demand for frictionless cross-chain transactions. By leveraging TRON's high-capacity network, the partnership enhances liquidity and accessibility in the stablecoin ecosystem.

TRON Partners with US Department of Commerce to Publish Economic Data Onchain

TRON has secured a landmark partnership with the US Department of Commerce, marking a historic milestone for blockchain adoption. The network will serve as one of the primary platforms for publishing official US economic data, starting with Q2 GDP figures. This is the first time such critical data will be anchored on a public blockchain.

The collaboration underscores TRON's growing role in enhancing transparency and accessibility of economic indicators. With billions in daily settlement volume and millions of transactions, the network has proven its scalability and reliability—key factors in its selection by a major government agency.

As blockchain use cases expand beyond finance, TRON's infrastructure capabilities position it as a critical player in data security and institutional adoption. The partnership arrives amid heightened crypto market activity, adding momentum to the sector's long-term growth narrative.

Tron Inc. Becomes Largest Public TRX Holder With $220 Million Treasury

Tron Inc. has solidified its position as the dominant public holder of TRX tokens after Bravemorning Limited exercised warrants to acquire 312.5 million TRX, valued at $110 million. The transaction elevates the company's stake in tron Inc. to 86.6%, bringing total investments since the June merger to $210 million.

The aggressive accumulation strategy has fueled a 1,128% stock surge over six months, though analysts caution about inherent risks in holding native tokens as treasury assets. CEO Rich Miller emphasized the strengthened position without addressing potential circular risks in the investment structure.

Regulatory filings reveal ambitious expansion plans, with the company seeking authorization for billion-dollar initiatives. The reverse merger with SRM Entertainment brought Justin SUN aboard as an adviser, lending credibility to Tron Inc.'s Web3 aspirations.

Is TRX a good investment?

Based on current technical indicators and fundamental developments, TRX presents a compelling investment opportunity. The cryptocurrency is trading at $0.3389 with bullish MACD momentum and strong institutional support. Key factors supporting investment include:

| Metric | Value | Implication |

|---|---|---|

| Current Price | $0.3389 | Below 20-day MA, potential upside |

| MACD | 0.006579 (bullish) | Positive momentum building |

| Bollinger Upper | $0.365 | Near-term resistance target |

| Institutional Holdings | $220M (Tron Inc.) | Strong corporate confidence |

William concludes: 'The combination of technical positioning and fundamental catalysts suggests TRX could appreciate toward $0.365 resistance levels, making it a favorable investment at current prices.'